The superyacht market preserves a historically high pace. By the end of the 3rd quarter of 2022 the overall sales of 30m+ yachts in 2022 are already higher than sales of any previous whole year except 2021 in almost all segments of the market. The sales skyrocketed in the 2nd half of 2020 as many buyers, including first-time yacht purchasers and former charterers, came on the market in search of an asylum and a safer means of transportation in the middle of the pandemics.

Pick of the market:

Top 3 yachts for sale under 5 years old

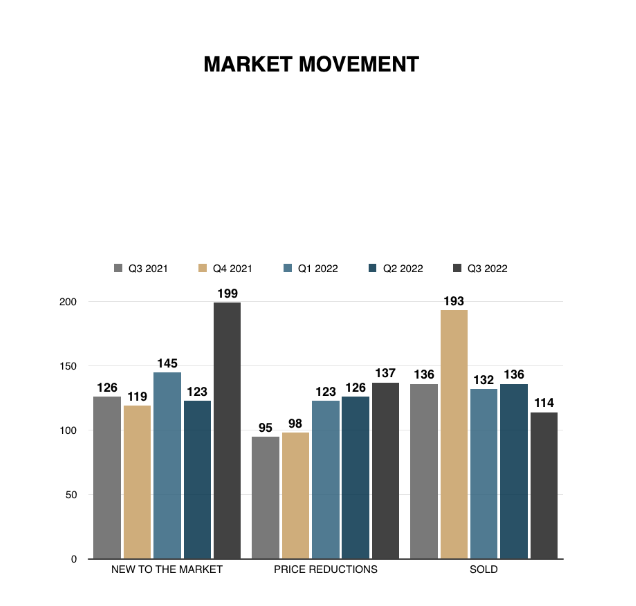

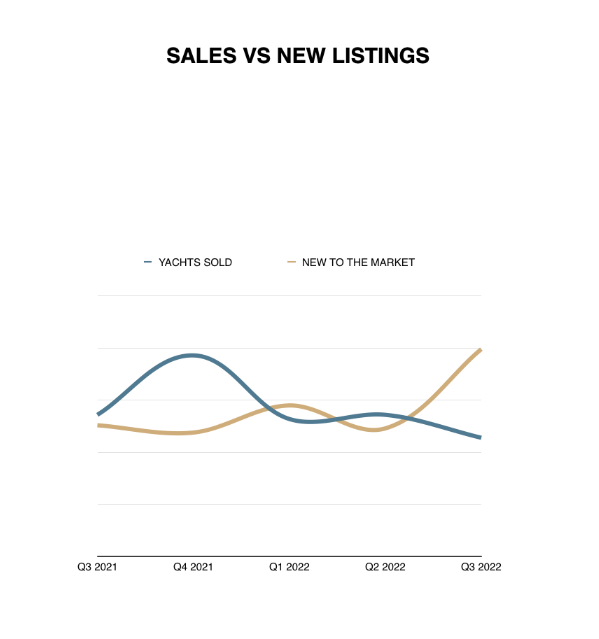

For many sellers, the post-Covid surge in demand became a signal to enter the market with speculative asking prices. This provided an increase in new listings in the beginning of 2022. However the buyers, which remain cost-conscious as ever, keep looking for reasonably priced opportunities, including off-the-market yachts. 2022 Q2 sales saw a small drop-off from the 2021 figures in almost all size segments of the superyacht market, though the sales were still higher compared to the corresponding periods of 2018, 2019 and of course 2020. The lack of supply and world events have understandably slowed the market. Besides, sales activity is generally quieter in summer as brokerage yachts become busy with owners' use and active charter schedules.

As an ending mark of the summer season in the Med and ahead of the autumn yacht shows Monaco and Fort Lauderdale, the brokerage market demonstrated a surge in the number of owners putting their boats up for sale in August-September. There were 65 new arrivals on the sales market in August and 87 – in September, with several big-ticket listings, most notably the 90m Phoenix 2 asking EUR 129,000,000 and 85.6m B2, asking EUR 88,000,000.

Pick of the market:

With more yachts entering the market and the exchange rates playing in favor of American buyers - the main driving force of the superyacht market - the sales saw a huge increase from the previous months in September, both in numbers and total price. The most expensive deal in Q3 was the sale of the 97m Carinthia IV with an asking price of EUR 95,000,000.

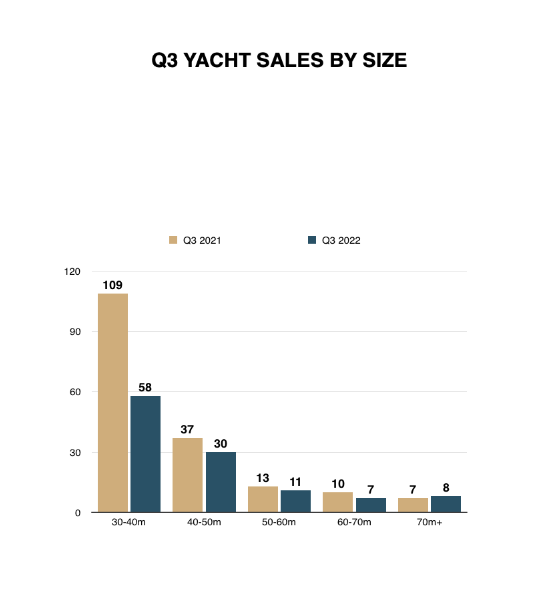

The majority of market transaction volume in 2022 continues to lay within the sub-50m range, with 30-40m yachts accounting for half of all sales. On average, yachts are sold within 12 to 18 months of being placed on the market. Quality and reasonably priced yachts aren’t sitting on the market for long. Speaking of the quickest deals since the beginning of 2022, the 42m Istros was sold in 53 days, 72m Stella Maris and 46.7m Odyssea shifted hands in 2 months.

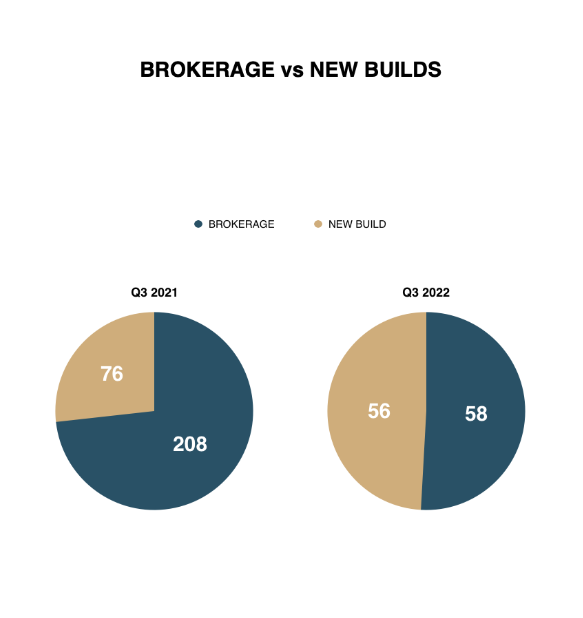

There is still a good number of people actively looking to buy a yacht and it helps to maintain prices at a relatively higher value than before. Sometimes sellers were only testing out the market with high prices and would seriously discuss a deal, but many owners stayed firm on their asking prices – not least because of the high replacement costs. In the last two years, on the back of increased demand, many shipyards raised their new construction prices by 10-20% – which is best noticeable in the semi-custom segment with well-known base price levels, as with Heesen and Amels. And now we can see a huge price gap between the new yachts and 5-15 years old brokerage yachts. Owners entering the market are focused on the new construction prices, while the buyers, on the other hand, focus on the average brokerage market prices of previous periods.

Pick of the market:

Major price reductions third quarter

As for the new build market, according to Boat International, the 2022 Global Order Book records an impressive 1,024 projects in build or on order, a rise of 24.7% on 821 in 2021. The demand for new construction projects remains consistent, despite the rising new build costs and longer delivery times. All the leading shipyards have their order books stretched into 2026. Even builders of production GRP yachts are now selling slots with deliveries in 2025. Because of the increased demand and the heavy workload in the yards, contracts are now being concluded 6 to 12 months before the start of construction work (mostly for small and GRP yachts).

But what looks like to be a success for the industry also gives some food for thought on whether or not the boom on the superyacht market is going to remain for long. Concerns are that as most of the leading shipyards operating in the production segment with certain model ranges are packed with orders for the next couple of years or more, it means that they are not able to build new generation yachts before they complete current builds. And by the time the new buyers will be able to start building, the models offered to them may become too outdated and less appealing. Along with a lack of inventory on the brokerage market this may create a downfall in sales.

We have seen quite a few good yachts coming into the market recently and expect to see stable market activity in the following months. However, though the demand for yachts remains ever high, the global uncertainty and lack of supply may put some serious pressure on the sales in 2023.

Sponsored by YT Partners

E. ask@yt.partners

T. +44 7442 526545