Trump's election as president of the United States marked a number of firsts, including the institution of what has historically become the wealthiest cabinet ever in existence in America. The billionaire's effect on politics and policy has become the subject of many international debates, yet his interests in yachting tend to be less talked about but remain no less fascinating when coupled with his administration.

In his former life as a billionaire businessman, Trump not only owned an 86m superyacht as well as a shipyard for a brief period of time, but he also ordered the world's largest yacht, although it was never completed. Meanwhile, US Secretary of Education, Betsy DeVos, with a net worth estimated at $1,5 billion, and her family have been linked to no less than 13 yachts over the years.

In 1980, the late Saudi businessman and arms dealer, Adnan Khashoggi took delivery of the 86 meter (282 ft) Nabila. Built by Benetti in Italy, she became the 8th largest yacht in the world and appeared in the 1983 James Bond movie, Never Say Never Again.

When Khashoggi, however, ran into financial problems, the Sultan of Brunei took possession of the yacht to cover one of his loans. The Sultan quickly flipped the yacht to Donald Trump for a reported $29 million in 1987. In an interview in 1988, Trump said he received a $1 million discount for agreeing to change the name from Nabila, Khashoggi's daughter.

Khashoggi probably spent $200 million building this yacht, probably the best yacht ever built. I purchased it for a business. I use it for my hotels. I use it for a lot of different charities.

After acquiring Nabila, Trump renamed the yacht to Trump Princess and had it refitted by Holland-based, Amels for a near $10 million according to the LA Times. The H on the helipad was also changed to a T to stand for Trump.

Spread into over 100 separate areas over five decks, Nabila was without a doubt one of the most complex yachts of her time. With luxurious materials including onyx used for her interior, the yacht was also ahead of her time from a technological standpoint. Remote controls were installs next to the bed for shades, room service, and the entertainment center.

Amongst the yacht's main feature was a hair salon with 3 separate chairs, a sauna, a private elevator for the owner, one for guests and one for the crew, a 2.4-meter in diameter spa pool with a waterjet behind bulletproof glass. Whilst still owned by Khashoggi, many arms deals were signed onboard the yacht.

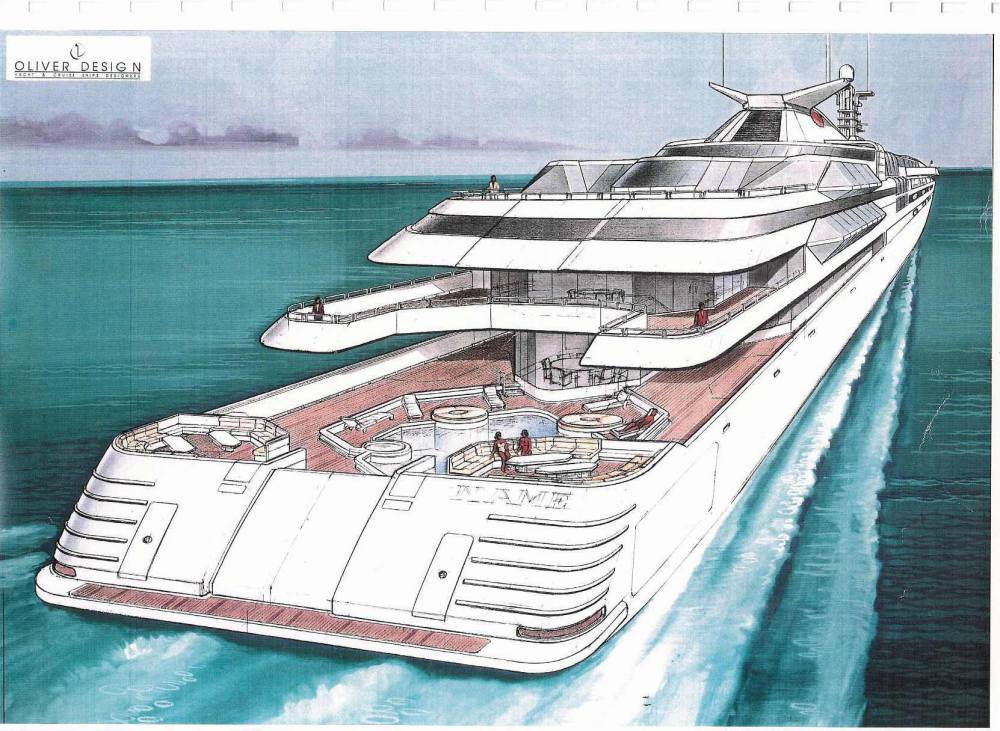

In June 1989, Donald Trump announced that he would build a larger yacht, "something in excess of 400 feet long, closer to 500 feet" as he told Newsday and that he was accepting bids from yacht builders for this project. Amels, then owned by a group of 4 British investors, secured the deal to develop the 128-meter Trump Princess II according to NRC.

In May 1990, it was announced that Trump bought Amels altogether. At a press conference in Makkum in 1990, Jeff Walker, VP of Trump's investment empire, denied that the shipyard was sold due to the previous owner's financial difficulties, which some have said, resulted from Trump canceling the construction of the Trump Princess II.

In September 1990, two months after the acquisition, Trump sold Amels to American businessman, Peter Kutell according to Deseret News due to financial problems. At the same time, the Trump Princess was put up for sale and all work on the Trump Princess II stopped. In 1991, Trump Princess was sold to Prince Al-Waleed for $19 million who renamed the yacht to Kingdom 5KR.

The superstructure for Trump Princess II allegedly remained at the Amels Makkum facility until summer 2001 when it was eventually removed. According to sources familiar with the matter, the superstructure is still parked at the Makkum facility, now owned by Feadship De Vries and reportedly sometimes used as a bike parking space.

Although Trump never came back to yacht ownership, other members of his cabinet remained involved in the space to this day. Betsy DeVos, US Secretary of Education, and her husband have a combined net worth valued at $5,1 billion. Amongst their long list of assets are no less than 10 yachts and reportedly an interest in the shipyard that built them.

Delivered in 2008 by US shipyard, Westport, Seaquest measures 50 meters (162 ft) and was designed by Donald Starkey. Reaching a top speed of 24 knots, she is part of the Westport 164 series. Interestingly, she's also not the only Westport 164 linked to the DeVos family as the 50-meter Legacy is also reportedly owned by the family.

Whereas the actual construction price of this particular Westport is unknown, as is typical with the vast majority of new build yachts, a similar 50-meter Westport sold at an asking price of $29,950,000 in November 2016. It is standard for the final, actual price to be 30-40% lower to the asking price in yachting.

Delivered in 2011, Legacy is a slightly updated version of the Seaquest. According to the media, the DeVos family has a solid preference for Westport yachts, having reportedly owned several of them in the past years. In fact, the family may even have acquired a stake in the US yacht manufacturer according to SYF.

Amongst the Westports linked to the DeVos is a Westport 112 from 2003 and a Westport 130 from 2005. Their fleet also includes an 85ft Pacific Mariner ( a brand owned by Westport) called Sun Quest. Additionally, an 80ft Hatteras called Kitsune can also be found in their fleet according to the media.

Although the DeVos fleet may already sound expansive as it is now, the family hasn't always been buying Westports and went through a number of other yacht shipyards as well. One of these superyachts was the 53-meter sailing yacht Independence, delivered by Italian shipyard, Perini Navi in 1998.

The yacht has since been sold, renamed to Jasali II and made available for charter from €138,600 per week. Accommodating up to 10 guests in 5 cabins, she stretches over a beam of 11.4m and can cruise at up to 12 knots.

Prior to their long run with Westport, the DeVos have reportedly owned no less than five Feadships according to SYF, all of which have been named Enterprise. The first to qualify as a superyacht would become Enterprise II, a 116ft Feadship delivered in 1970 now known as Utopia II.

Although from a different era and with different standards, in the 1970s, Utopia II was a true superyacht for its time. Amongst her classical feature are a round aft with an open top deck, partly used to store its tenders. 10 years following her delivery, a new Enterprise was built by Feadship, this time measuring 131ft.

Now known as Seagull of Cayman following changes of ownership, she features several enhancements over the previous Enterprise. The most noticeable of these is a dedicated sundeck, an upper deck skylounge and a larger main salon aft of the main deck. Several weeks ago she was put again on the market at an asking price of €5,900,000.

Yet another improvement on Enterprise III, the 149ft Enterprise IV was also built by Feadship in 1985. Through the Enterprise line can be seen the growth of a niche industry into the superyacht sector it is today. Now known as Explora, the yacht features larger windows, a sleeker line and a swimming platform aft of the yacht, all of which weren't found on classical yachts.

The last Enterprise to be built was delivered by Feadship in 1993 and is today known as Chantal Ma Vie. Measuring 55-meters (179 ft) in length, she already was a good representation of the modern superyacht, featuring a sleek line, large sundeck, expansive lounges, spacious cabins, a swimming platform and purpose-built tenders. In 2010, she was sold at an asking price of $15,9 million to her current owner.

Although their effect on US policy can be polarising and debated throughout the world, the effect that Trump and member of his administration have had on yachting throughout the past decades has undoubtedly played an important role in growing the market to the point where it is today.