Denison Yachting has published its quarterly business report. According to the company, the third quarter of 2022 has been ‘a challenging quarter for the boating sector. Nevertheless, taking pre-pandemic numbers as a baseline, the industry demonstrated remarkable resilience’. Here are the most important parts of the report.

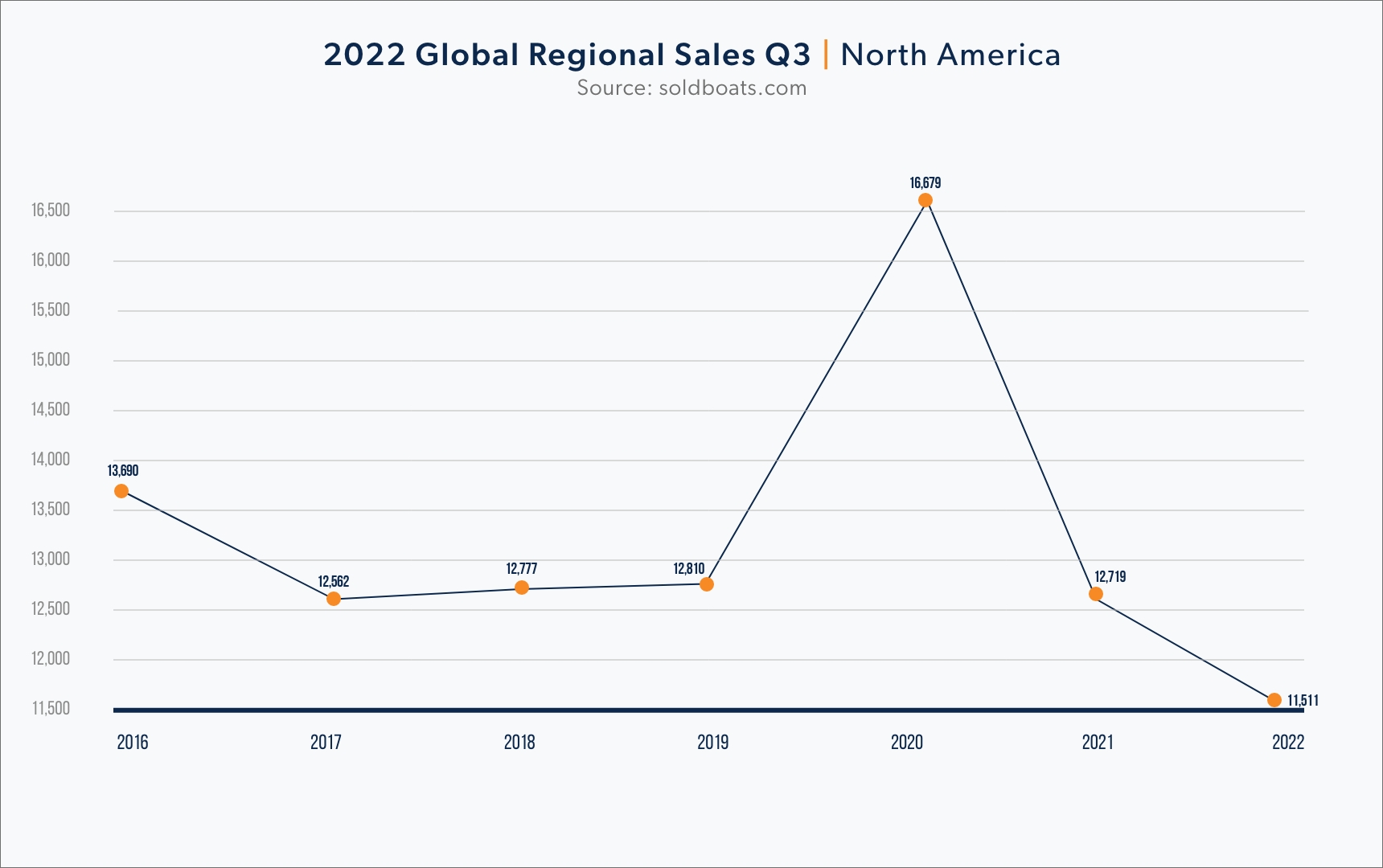

Globally, customers bought 10% fewer boats than they purchased in the third quarter of 2021, a 30% drop from the record sales of the third quarter of 2020. However, overall numbers were just 9% below Q3 2019, indicating that the challenges the market has faced this year have yet to do much damage to demand. Therefore, it is not surprising that the National Marine Manufacturers Association maintains that 2022 is on track to be a very healthy year for the boating industry.

Global Yacht Market Performance in Q3 2022

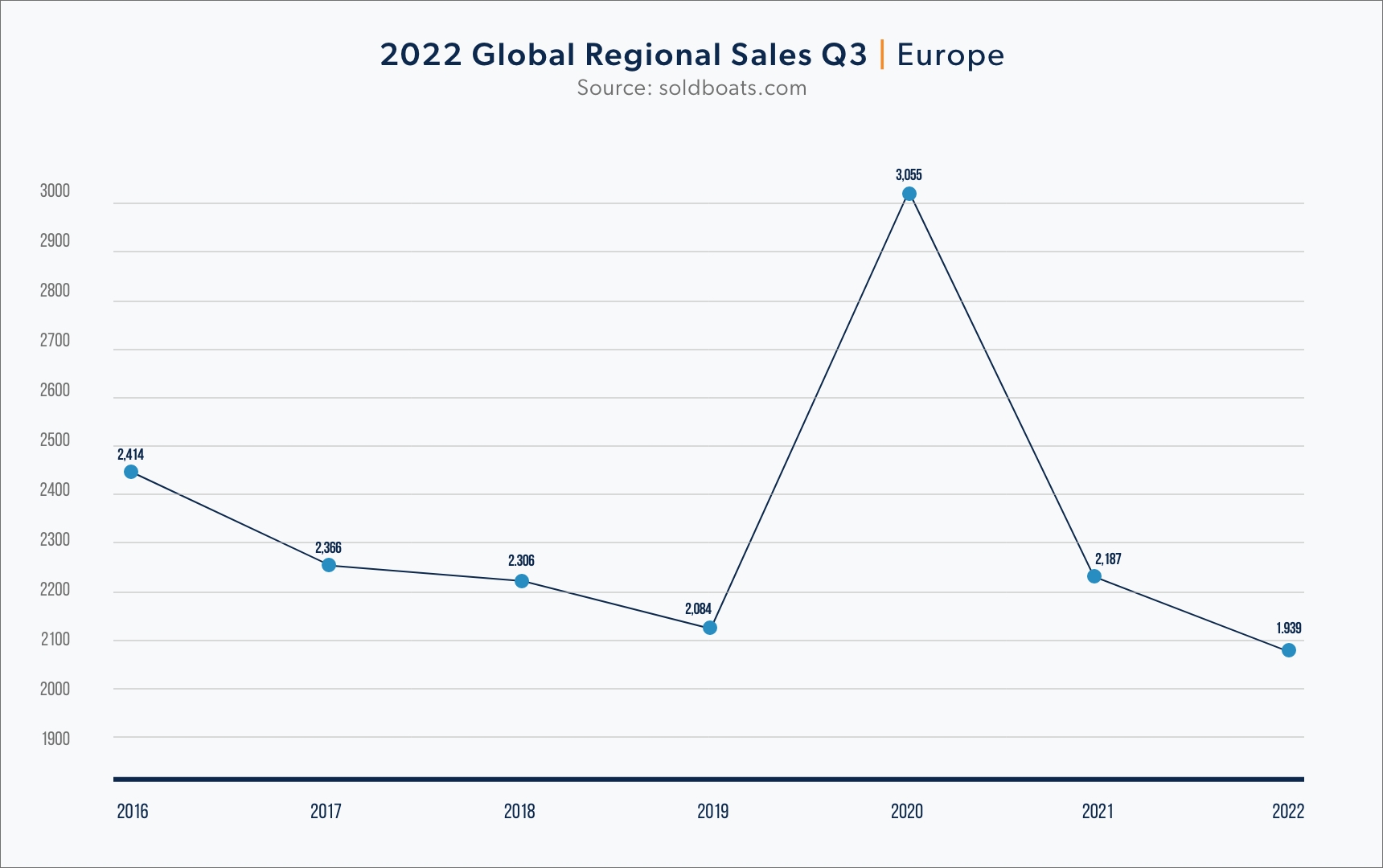

Following a lackluster Q2, Q3 was a tumultuous quarter for the global boating market. Sales across all the major yacht markets dropped considerably from Q3 2021. North America, the world’s largest boat market, recorded 9.5% lower sales than in the same quarter last year. In Europe, customers bought 11% fewer boats in the usual yachting hotbeds of France, Italy, Spain, and the Netherlands than in Q3 2021.

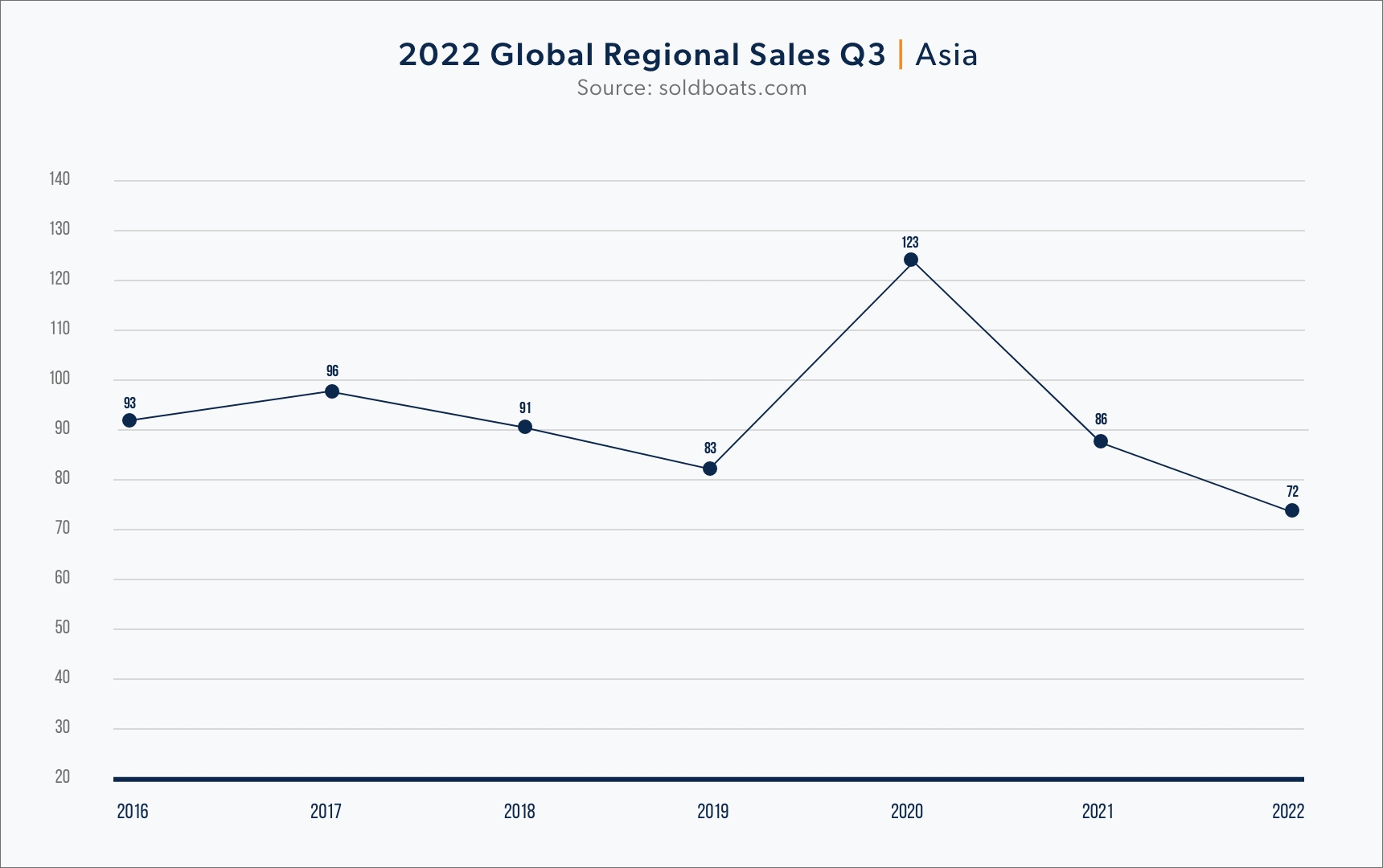

The numbers were even bleaker in Asia, which saw a 19% drop in purchases from Q3 2021. Customers in China, Japan, and Singapore bought fewer boats in Q3 2022 than in any third quarter since 2015.

The silver lining in all of this is that the industry’s performance was still strong, given the challenges it faced in the third quarter of this year. Despite pressures from inflation, persistent supply chain challenges, and an active 2022 Atlantic Hurricane Season, sales across some key boating destinations, including the U.S. Southeast region, remained on par with pre-pandemic numbers.

Strong Performance of Luxury Yacht Charters in Q3 2022

While new boat sales struggled to maintain the momentum of the last two years, yacht charters continued to boom in Q3 2022. Thanks to the economic uncertainty, many potential customers postponed their purchase decisions, opting instead for short-term rental options. More boat owners also put their vessels up for charter to offset the cost of ownership and earn additional income.

Chartering appeals to customers because it allows them to “test drive” a luxury lifestyle before making a multimillion-dollar purchase. Leading yacht brokers also provide comprehensive itineraries and services, so customers can relax and enjoy their vacation without worrying about logistics.

So far, market reports indicate that luxury yacht charters have increased by 20% in 2022 compared to 2021. Denison expects the number of people chartering yachts to grow in Q4 and beyond, driven by continued interest from first-time charterers and experienced boaters alike.

Bukit Merah, Singapore

What Does Q4 2022 Have in Store for Yachting?

Fortunately, all signs still point to a bright future for the boating industry. For instance, growth in the U.S. Southeast region and solid performance in the center console boat category indicates that the demand for recreational boating is still high.

Furthermore, according to the U.S. Bureau of Economic Analysis, outdoor recreation activities have thrived since the lockdowns eased in 2021. This year, boating and fishing have increased their contribution to the outdoor recreation economy by 22%, indicating sustained interest in water-based activities from 2021.

Going into the fourth quarter of the year, Denison expects performance to mirror pre-pandemic levels for another quarter. Considering the challenges the industry has faced this year, being able to sustain pre-pandemic numbers gives us hope for more robust performance in 2023 and beyond.

Denison has long been a leader in the yachting industry with a rich family history dating back to 1948, and the start of Broward Marine in Fort Lauderdale. Today, the company provides complete yachting services worldwide, including superyacht sales, yacht charter, crew placement, and new construction. Denison operates out of 21 waterfront offices in the United States, and one location in Monaco with a team of 100+ licensed and bonded yacht brokers.

Credits: Denison Yachting; Unsplash